3 Steps To Buying Your First Home

Most people dream of buying their own home. There is little to compare to the joy of acquiring your first home.

Buying a home is one of the most important financial decisions you can make. The advantage is that its value will most likely appreciate over the long term.

Here are three important steps to consider:

What is your budget?

How much can you afford to pay for the privilege of owning your own home? Keep strictly to your price range and don’t be tempted to go above.

Work out your monthly bond instalments and shop around for the best rate. Think about asking a bond originator for help.

Remember that interest rates can change over time. So be prepared in case they go up.

Do you have a cash deposit? Most first-time buyers will need to pay at least a 5% to 10% deposit. You will also need to pay the transfer costs and transfer duty. Work these out before you make an offer.

House hunting

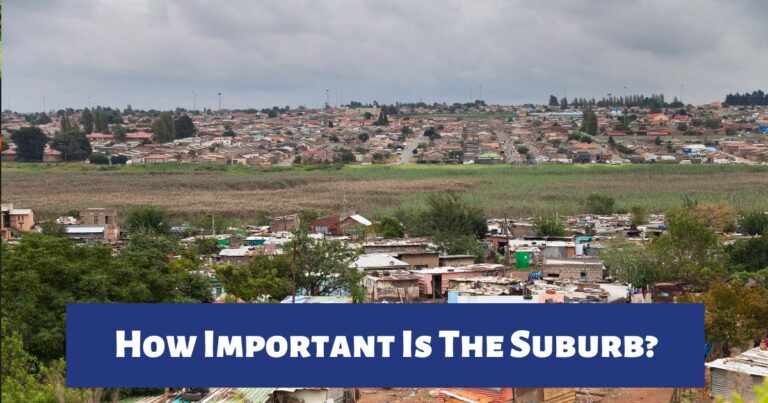

Location – what areas will you concentrate on? What are the demographics of the area? Does it need to be a pet-friendly area? Do you need to be close to good schools or a hospital?

Make up a short list of must-haves and nice-to-haves.

Look at the style and condition of the house and garden. Does the number of bedrooms, bathrooms and living areas fit your needs? Are there enough parking spaces?

Making an offer

Now that you have found the right home, it’s time to put in an offer.

This can be a tense period – will the seller accept, or perhaps make a counter offer? Often people are on tenterhooks waiting to hear the outcome.

Remember, property transactions must be in writing.